Nobody likes telling their customers that their preferred payment method is not accepted. Or worse still, that you need to add a surcharge.

The best mix of payment options for your business will make the point of sale transaction fast and painless, have the lowest impact on your gross profits, and also extend your cash flow as much as possible. That's the dream, anyway.

The world of banking payments can be confusing and complicated, which is why we offer the most easy to use credit card comparison service. Pricing is not always clear. Add to that the fact that some payment methods stack on top of another, like ASX darling Afterpay which draws on your Visa or Mastercard debit or credit card, which in turn is tied to your bank account.

The payments industry calls this stuff the cost of acceptance but you probably call it the cost of doing business.

For customer-facing offline bricks and mortar businesses, accepting payment might involve taking cash, as well as all the major cards and digital wallets plus a Buy Now Pay Later option. Meanwhile, you pay suppliers with your points-earning business cards, and use direct debits or bank transfers for everyone else.

For online shopping and digital businesses, credit cards are still the preferred method of payment for almost half of global shoppers. (Statista)

In some markets, digital wallet apps and mobile currencies might overtake credit and debit card transactions by the end of this year. (Reuters)

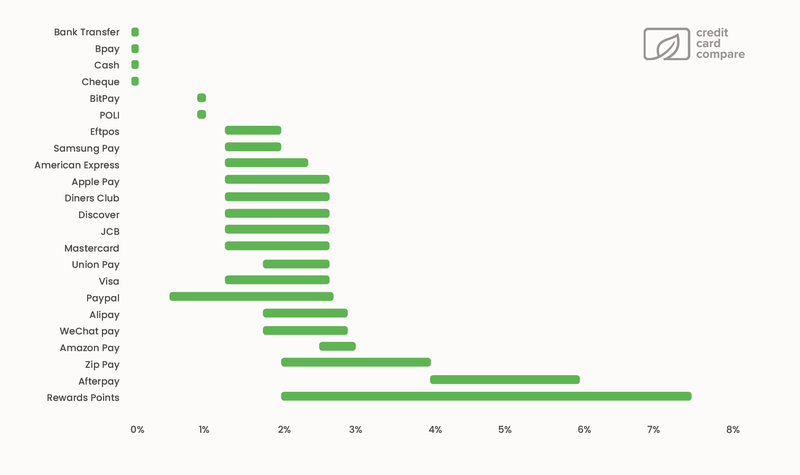

Take a look at the cost of accepting payments across many payment types: cards, cash, bank transfer, digital wallets, and Buy Now Pay Later schemes.

Key takeaways

- Compare the cost of getting paid via 23 methods including Amex, Mastercard, Visa, cash, Afterpay and Zip Pay.

- Easy to read chart ranks the cost ranges from cheapest to most expensive.

- Figure out the right mix of payment options for your business with pros, cons, costs and who it's best suited for.

Inside this comparison

Afterpay

- Pros: Afterpay is ideal for baskets valued at $1,000 or less. Opens your business up to a wider audience, especially younger shoppers. Seamlessly integrates with major shopping cart solutions. Potentially reduces abandoned cart rates for credit-card-shy shoppers who may not be able to own products outright but want instant gratification, and would rather budget for four interest-free payments over eight weeks.

- Cons: The cost of accepting payment is actually as much as three times higher than accepting credit cards. If you struggle to justify the cost of accepting premium credit cards like Amex, then you'll also struggle to accept payment from Afterpay. Settlement time takes up to two business days.

- Fees: Get ready to pay between 4% and 6% of the transaction value plus 30 cents per transaction.

- Suitable for: Bricks and mortar retailers and online shops with average order values of under $1,000, targeting 18-40-year-olds who probably only have a debit card.

Alipay

- Pros: Alipay is the preferred Chinese method of payment. Over 1.2 million Chinese visitors come to Australia each year spending on average $8,000 per visit. And when combined with Chinese students and nationals residing in Australia that's a lot of potential customers. Accepting payment via Alipay might help to attract more Chinese customers paying for goods and services in Australia.

- Cons: Only a select number of merchant services allow you to handle Alipay. Extra training may be needed for staff to handle the different sales process at the point of sale.

- Fees: Typically around 1.76% but expect it to range from 1.50% - 2.90% of the transaction value.

- Suitable for: Any tourist operators, shops and businesses with large numbers of potential Chinese customers.

Amazon Pay

- Pros: Let customers pay using the native Amazon payment platform of one of the world's largest companies.

- Cons: Not available in Australia, yet.

- Fees: In the US it costs 2.90% of the transaction value. In Australia expect it to cost approximately 2% - 3% of transaction value.

- Suitable for: Amazon shoppers.

American Express

- Pros: People with American Express cards tend to spend more and will try to use their cards wherever possible in order to earn valuable Membership Rewards points. So there's an opportunity to build repeat business with Amex cardholders. All Amex cards are Tap and Go enabled and can be used with Apple Pay, Google Pay or Samsung Pay, meaning you can process customers faster at the point of sale.

- Cons: The cost of handling the transaction is higher than other credit cards and debit cards. This is why you quite often see businesses refusing to take Amex or adding a surcharge that is an additional amount on top of the purchase price – a practice that Amex discourages and cardholders strongly dislike.

- Fees: Approximately 1.25% - 2.65% of the transaction value.

- Suitable for: Online shops, especially those partnered with Amex Membership Rewards. All offline shops, stores, and businesses, especially those who want to participate in the annual Amex 'Shop Local' campaign.

Further data included in our research of American Express statistics.

Apple Pay

- Pros: Popular digital wallet enables customers to digitally store credit and debit cards on their iPhone. Makes for faster cardless payments in-store using an iPhone and eliminates the need for customers to manually enter their card and billing information each time for online shopping. Practically the same as accepting payment via any Tap and Go contactless card. Many banks, mutuals and credit unions now support Apple Pay for their cards. Also, it can work really well for mobile websites and in-app stores where payment can be taken without entering a card number.

- Cons: None really, other than slightly higher costs.

- Fees: 1.25% - 2.00% of transaction value.

- Suitable for: Bricks and mortar stores where your iPhone-loving customers want the convenience of using their digital wallet. It can also work well for eCommerce stores.

Most banks in Australia now offer debit and credit cards that can be added to your Apple Wallet. You can compare credit cards with Apple Pay here.

Bank transfer

- Pros: No fee to move money from one bank account to another. The NPP upgrade to the system allows for super-fast Osko near-instant bank-to-bank payments.

- Cons: Can be an awkward way of asking customers for money. They'd better get that BSB and Account Number correct otherwise money can get lost or bounce back. Still a sluggish way to receive money (1-2 business days) if Osko payments aren't used.

- Fees: No fees!

- Suitable for: Unsophisticated B2B transactions especially for long-standing business arrangements. Also suitable for large purchases when payment doesn't need to be immediate, and for customers who are not fussed about earning rewards.

Bitcoin

- Pros: Bitcoin is the currency most talked about by investors and media.

- Cons: Not well understood in everyday life and hasn't gained widespread acceptance.

- Fees: Approx 1.00% of the transaction value.

- Suitable for: Merchants who have customer base into cryptocurrency.

BPAY

- Pros: Thought to be "Australia’s favourite way to pay" for bills, BPAY has a quite low fixed cost, especially if your AOV is high. Some online stores are offering it as a payment method.

- Cons: There have been technical glitches and security issues in the past. Can take 1-2 business days for money to arrive.

- Fees: $0.65 to $0.70 per transaction, depending on your bank. Because of this, most businesses will absorb that cost for customers while offering alternative payment methods that are free.

- Suitable for: Businesses that issue bills on an ongoing basis, or invoices to clients.

Cash

- Pros: Simple, fast, and effective. The only good backup when all the other systems fail.

- Cons: Easy to steal. Opens you up to accepting counterfeit notes. It's 'dumber' in terms of linking revenue data to customer activity. Physical cash is slowly going away so fewer people carry cash in 2019, and in smaller denominations too. There’s also the time, hassle and security risk of having to physically take wads of cash to the bank to make deposits.

- Fees: No fees at the point of sale. However, there may be cash deposit fees of between 60 cents and $2.50 when you take it to the bank. Why the difference? Cash deposited over-the-counter at the branch of many big banks will cost you much more than if you use a Quick Deposit ATM in the branch.

- Suitable for: Most bricks and mortar retail stores and tradies who take payment in cash.

Cheque

- Pros: None, really. The last resort if all card terminals break, digital systems go down and the till won’t open. Maybe the fun factor if you accept massive novelty cheques?

- Cons: Time-consuming, archaic and means you have to head over to the bank to make a deposit. Staff under 35 won't know how to process a sale. And there’s also a risk that the person writing the cheque may not have enough funds in their account to cover their purchase by the time your deposited cheque is processed.

- Fees: Expect to pay around $1.50 - $2.50 per cheque deposited, depending on whether you use an ATM or a real person over-the-counter in a branch. Hanging on to cheques is expensive.

- Suitable for: Tradies.

Diners Club

- Pros: People who use a Diners Club card tend to be higher-spending customers. Companies get their employees to put business expenses on Diners Club corporate cards.

- Cons: Not too many people have Diners Club cards in Australia.

- Fees: Between 1.25% - 2.65% of the transaction value. Typically somewhere around 1.75% of the transaction value.

- Suitable for: Businesses and industries where there's a demand for Diners Club.

Discover

- Pros: Take payment from American Discover credit card holders.

- Cons: Not too many visiting Americans will expect to use their Discover card in Australia. However, if you have a business that sells to the US market you may want to offer it as a payment option.

- Fees: Expect it to cost 1.25% - 2.65% of the transaction value.

- Suitable for: Businesses serving American customers visiting Australia or customers in the US shopping online.

EFTPOS

- Pros: Millions of Australian cards are issued by eftpos, and many enabled with Tap & Pay™ for fast and secure in-store purchases under $100.

- Cons: None really. Not as ubiquitous as Visa or Mastercard.

- Fees: Approximately 1.25% - 2.00% of transaction value.

- Suitable for: Any business, online and offline.

Google Pay

- Pros: Popular digital wallet enables customers to digitally store credit and debit cards on their mobile phone. Makes for faster cardless payments in-store using a mobile device and eliminates the need for customers to manually enter their card and billing information each time for online shopping. Practically the same as accepting payment via any Tap and Go contactless card. Also, it can work really well for mobile websites and in-app stores where payment can be taken without entering a card number.

- Cons: Processing fees. People may have privacy concerns considering it's a Google product.

- Fees: None, other than what your POS card machine charges in processing fees.

- Suitable for: Both brick and mortar and online stores.

JCB

- Pros: Take payment from holders of the JCB credit card, Japan’s only international payment brand.

- Cons: Not too many people in Australia have a JCB card. However, if you have a business that sells to a Japanese market you will want to accept it.

- Fees: Expect it to cost 1.25% - 2.65% of the transaction value.

- Suitable for: Businesses serving Japanese customers or clients in Japan or visiting from Japan.

Mastercard

- Pros: Mastercard credit card or debit cards are widely available and accepted just about everywhere. The Mastercard PayPass Tap and Go feature means you can process customers faster. Mastercard payments can be made via Apple Pay, Google Pay or Samsung Pay digital wallets.

- Cons: The RBA estimates merchants actually pay more with Tap and Go (around 0.55%, compared to 0.15% on EFTPOS).

- Fees: Approximately 1.25% - 2.65% of the transaction value.

- Suitable for: Any business or retailer, online or offline.

PayPal

- Pros: Well known online payment giant. Customers can easily link to it to draw funds from their bank accounts, debit cards, and credit cards including American Express. PayPal is available at practically every online store. Integrates easily into shopping carts.

- Cons: Can be expensive for the merchant to accept. The platform has also been susceptible to a range of chargeback scams. Introduces an extra step at the checkout stage. Customers forgetting their Paypal password can be a pain.

- Fees: You’re likely to pay between 1.1% and 2.6% plus a fixed fee of $0.30 per transaction made in Australia (up to 3.6% for overseas purchases in a foreign currency).

- Suitable for: Online stores.

POLi

- Pros: Customers make secure payments from Internet Banking. Money gets sent to your business bank account and, unlike other payment methods, you aren’t held in limbo waiting for settlement.

- Cons: Requires some set up and integration work with your eCommerce platform. Payments are non-reversible, which is more of a concern for customers than merchants but it has the potential to cause issues. Some bank accounts don't integrate with POLi due to security concerns.

- Fees: Charges 1% of the transaction value, capping out at $3.00 plus GST.

- Suitable for: Only online businesses with large basket sizes that need to give customers a low-cost payment option. Airlines have led the charge. Or businesses that need to fund an online account/wallet such as investor platforms or betting sites.

Rewards points

- Pros: Australians are sitting on billions of rewards points. Give them the option to pay with this unique currency. Unique marketing opportunity that could set you above the competition.

- Cons: Restrictive access makes this a very niche payment method. Not a well understood method of taking payment. And if not negotiated correctly it could end up costing you a lot more than other payment methods.

- Fees: Nothing published. No fees as such, provided you adjust your store prices appropriately to cover the cost of ‘giving away’ items in exchange for rewards points. If you want to go down this road, it pays to do your research, so find some guides that will help you create a rewards program and store that doesn’t harm your cash flow.

- Suitable for: Successful eCommerce stores with sufficiently advanced shopping carts, tracking software and customer service processes.

Samsung Pay

- Pros: Popular digital wallet enables customers to digitally store credit and debit cards on their Android device. Practically the same as accepting payment via any Tap and Go contactless card. It makes it possible to conduct fast cardless payments in-store, using a Samsung smartphone. Many banks, mutuals and credit unions now support Samsung Pay for their cards.

- Cons: None really, other than slightly higher costs.

- Fees: 1.25% - 2.00% of transaction value.

- Suitable for: Bricks and mortar stores where your Samsung-loving customers want the convenience of using their card loaded onto a digital wallet.

UnionPay

- Pros: Helps to attract more of the 1.2 million Chinese who come to Australia each year. Some research suggests that Chinese visitors spend an average of $8,000 per visit. And when combined with Chinese students and nationals who live in Australia, tourist operators, shops and businesses with large numbers of Chinese customers probably should let them pay using UnionPay.

- Cons: Not all merchant facilities are set up to accept UnionPay cards and it can cost extra on some merchant plans.

- Fees: 1.25% - 2.65% of the transaction value. Typically somewhere around 1.75%.

- Suitable for: Any tourist operators and businesses with large numbers of Chinese tourists.

Visa

- Pros: Visa credit cards and debit cards with Visa payWave Tap and Go means you can process customers faster at the point of sale.

- Cons: The RBA estimates merchants actually pay more with Tap and Go (around 0.55%, compared to 0.15% on EFTPOS) so this is something to bear in mind in case you want to pass that cost on to the customer.

- Fees: Approximately 1.25% - 2.65% of the transaction value.

- Suitable for: Everyone, online and offline.

WeChat Pay

- Pros: Chinese Digital wallet linked to major bank accounts and cards in China. Popular for Chinese tourists and students living in Australia. Therefore, accepting payment via WeChat Pay might help to attract more Chinese customers.

- Cons: Only a select number of merchant services can accept WeChat Pay. Extra training may be needed for staff to handle the QR code scanning process at the point of sale.

- Fees: Typically around 1.76%, but expect it to range from 1.50% - 2.90% of the transaction value.

- Suitable for: Any tourist operators, shops or businesses with large numbers of potential Chinese customers.

Zip Pay

- Pros: Zip Pay is a major competitor of Afterpay. Open your business up to younger shoppers who don't have a credit card and may not be able to make purchases of under $1,000 outright. Instead, they can spread the cost out over eight weeks. Settlement time is usually the next business day. Seamlessly integrates with major shopping cart solutions.

- Cons: The cost of acceptance is lower than Afterpay, but still up twice as much as premium credit cards – including Amex. If you struggle to justify premium credit cards like American Express then you'll struggle to accept payment through Zip Pay.

- Fees: Expect to pay 2% to 4% of the transaction value plus 15 cents per transaction.

- Suitable for: Bricks and mortar retailers and online shops with average order values of under $1,000, targeting 18-40-year-olds who probably only have a debit card.

Overview

The statistics and research have been updated per the last updated date for freshness, accuracy, and comprehensiveness.